The accounting profession is broadly concerned with the measurement and communication of financial information, and the analysis of said information. Much of the profession is concerned with ascertaining or measuring rights and obligations over property, or planning how to best allocate financial resources. For accountants, using blockchain provides clarity over ownership of assets and existence of obligations, and could dramatically improve efficiency. Stay tuned for part two of this series, which will cover the remaining five must-have features of an enterprise crypto understanding your chart of accounts accounting software solution. A data warehouse is a central repository where data from various sources can be stored and accessed.

Extensibility: API Synchronization, Data Warehouse Access, and Data Reconciliation

There are many blockchain applications and start-ups in this field, but there are very few that are beyond the proof of concept or pilot study stage. Accountants are already participating in the research, but there is more for the profession to do. Crafting regulation and standards to cover blockchain will be no small challenge, and leading accountancy firms and bodies can bring their expertise to that work. Performing confirmations of a company’s financial status would be less necessary if some or all of the transactions that underlie that status are visible on blockchains. Sage Intacct is an accounting software package with built-in tools to analyze and drill down to real-time source data.

- Automate processes on flexible schedules, from integrations to month-end activities and notifications.

- Alongside other automation trends such as machine learning, blockchain will lead to more and more transactional-level accounting being done – but not by accountants.

- Supports complex structured businesses across domestic international subsidiaries to automate inter-company workflows.

- Details on the potential of blockchain, its implications for auditors, how the accountancy profession can lead and what skills are necessary for the future.

- When in doubt, please consult your lawyer tax, or compliance professional for counsel.

Explore Our Solutions

QuickBooks is an accounting software package that offers on-premises accounting applications and cloud-based versions. Out-of-the-box connections might sound convenient, but they often fall short when it comes to meeting unique business needs. Bitwave offers customizable data integrations across 50+ blockchains, protocols, and exchanges. NODE40 is a financial services provider for individuals and businesses that have interacted with cryptocurrency. Out of the box crypto balance sheet, income statement and trial balance-save FP&A and strategic finance resources every month. These articles and related content is the property of The Sage Group plc or its contractors or its licensors (“Sage”).

Sustainability and climate change

We lead the industry with our ability to capture and report your on-chain transaction data with instant, audit-ready invoice-matching and how to write goals and objectives for grant proposals smart categorization workflows. Accointing.com is an accounting, tracking and tax optimization tool for Bitcoin and other cryptocurrencies. CPAs and accountants can trust Sage’s tools and resources to grow their accounting firms and better serve clients. Details on the potential of blockchain, its implications for auditors, how the accountancy profession can lead and what skills are necessary for the future. With one click you can mark the current value of your digital asset holdings to close your books faster, and more accurately.

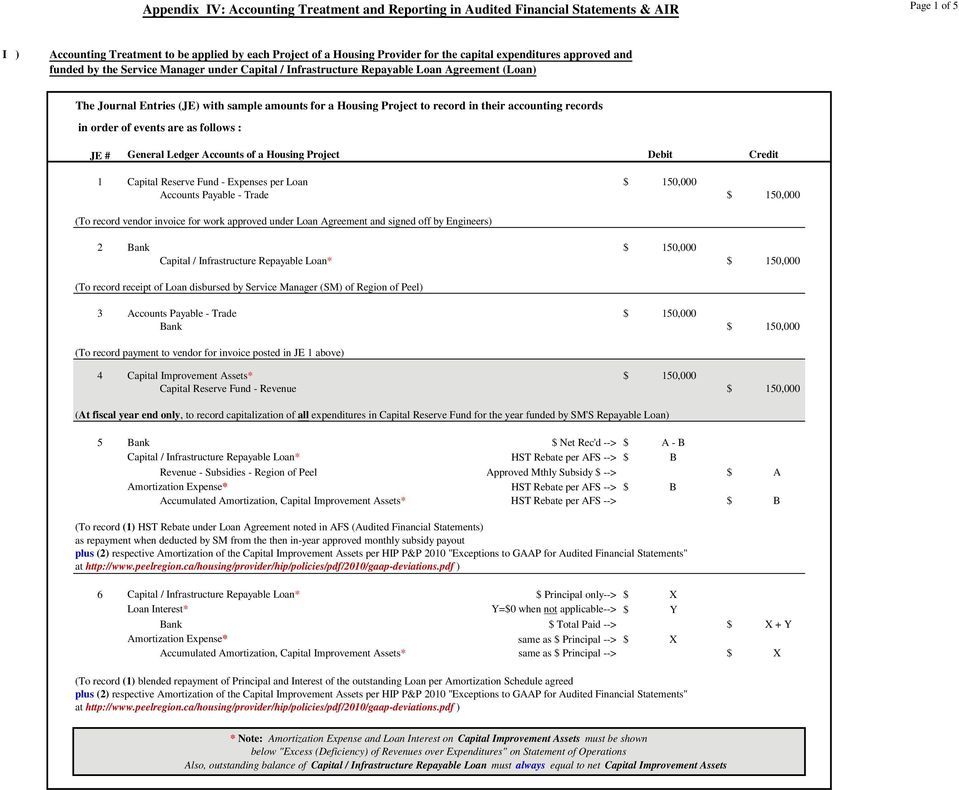

This allows businesses to have a comprehensive view of their digital assets and helps them make informed decisions. Enterprise-grade crypto accounting software needs to include robust payment processing functionality to support accounts payable and accounts receivable operations. For accounts payable, it how to post journal entries to the general ledger examples and more is important for businesses to have the ability to pay vendors with digital assets. This can be done using a payment processing platform that allows businesses to send bulk payments with different amounts to different addresses.

Please do not copy, reproduce, modify, distribute or disburse without express consent from Sage.These articles and related content is provided as a general guidance for informational purposes only. These articles and related content is not a substitute for the guidance of a lawyer (and especially for questions related to GDPR), tax, or compliance professional. When in doubt, please consult your lawyer tax, or compliance professional for counsel. Sage makes no representations or warranties of any kind, express or implied, about the completeness or accuracy of this article and related content. When you leave a comment on this article, please note that if approved, it will be publicly available and visible at the bottom of the article on this blog.

Xero is an online accounting software platform that allows businesses to see their cashflow in real-time. Cryptoworth tracks crypto , connects wallets and exchanges and tracks transactions and streamlines bookkeeping operations. There are a few characteristics of blockchain technology that make it unique and differentiated versus other market options that employ decentralized ledger technology.

From Blockchain to Balance Sheet, Bitwave’s Got Your Back

A comprehensive crypto accounting solution should, at a minimum, have the ability to reconcile data from internal, external, and on-chain systems (sometimes referred to as triple-legged data reconciliation). Introductory pricing starts at less than $100 a month and ranges to over $750 a month depending on the product’s features, number of transactions, users, wallets, and exchanges supported. Another important feature of an enterprise-grade digital asset reporting platform is the ability to export raw data and run conditional scenarios. This allows businesses to analyze their data in more detail and explore different scenarios.